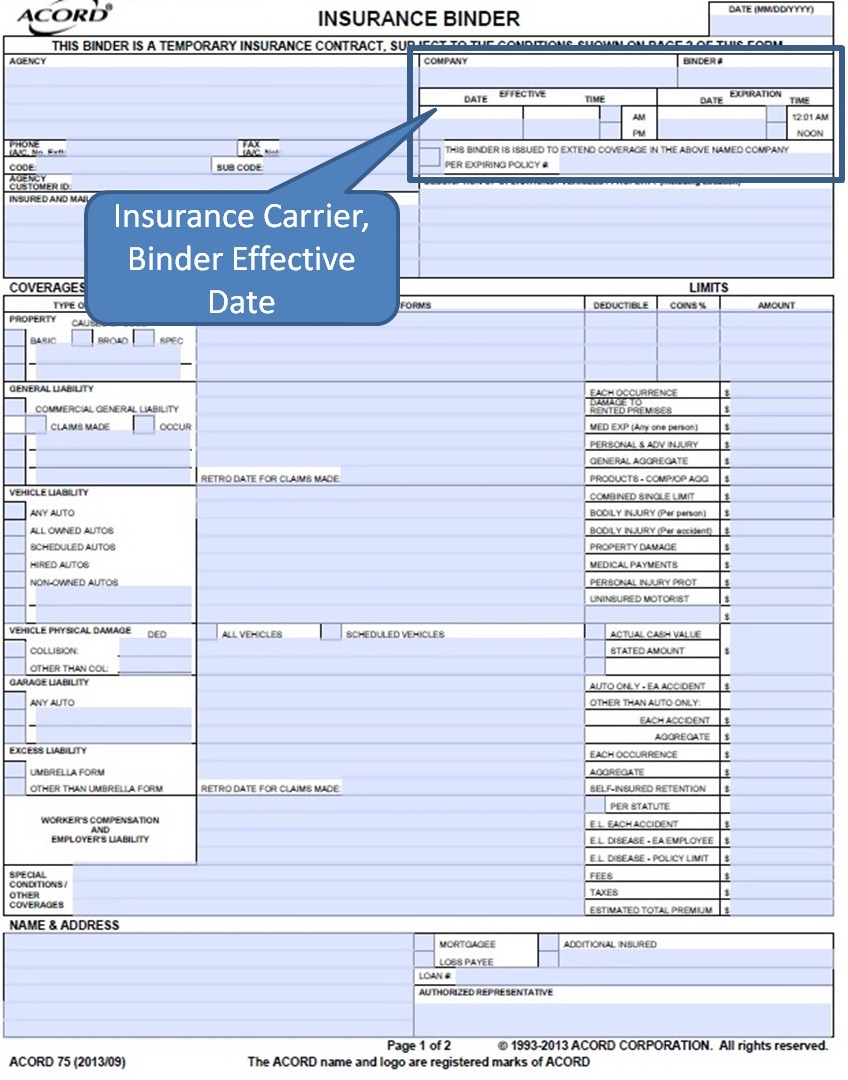

It remains in effect for a short time, typically 30 to 90 days. It's called a binder because it "binds" your coverage and creates an insurance contract and is used temporarily until the policy is issued.Ī certificate of insurance is a form of proof of insurance warranting that you have coverage for a specific period.Īn insurance binder is a brief document that serves as a temporary insurance policy. When you have business insurance policies you will often hear talk of your insurance binder and your certificate of insurance, but do you know the difference?Ī binder is a contract of insurance. Binders will also make mention of deductible-the amount the policyholder has to pay before insurance kicks in to cover.The Difference Between a Binder and a Certificate of Insurance This will be the person who took out the policy and the person or people to whom payment will be made in the event of a successful claim. The person or people named as the insured and loss payee.From a personal home to commercial property to a car, truck or RV, this part of the binder will let your lender know what you are insuring. The perils relate to the type of insurance but go into more detail as to what, exactly, is covered in terms of perils (e.g.

Perils you’re insured against under the policy.These details will include contact information for the insurance company, a policy number and customer ID. the time limits on the policy before it expires.) Your homeowners insurance binder will include the amount for which you are covered, which should be for equal to or more than the cost to replace the house. For example, property, liability, flood insurance, etc. The type of insurance refers to what types of plans you have in your policy. The home insurance binder shows your lender the important information about your policy that’s needed to secure a loan.

0 kommentar(er)

0 kommentar(er)